Cash Out Refinance

With traditional lenders you are limited to strict loan parameters. We have partnered with a top hard money lender in the market, focusing on equity over borrower financials. This gives our clients the liquidity needed for their individual situation.

Our underwriting guidelines for cash-out refinance loans focus on equity, not borrower credit. We have originated cash-out refinance loans for borrowers with low credit scores, prior bankruptcies, and foreclosures. If a bank turns you down for a cash-out refinance loan, call us!

We can often provide you with same-day pre-qualification on a cash-out refinance loan. Please complete our Cash-Out Refinance Loan Interest Short Form to get started.

Common Refinance Scenarios

Situations for cash-out refinance loan scenarios include, but are not limited to:

- Free and Clear Property

- Purchasing another property

- Crossing another Property

- Paying for Tenant Improvements

- Paying for Rehab Work on a Distressed Property

- Business Line of Credit Pulled

- Pay for Equipment, Inventory, or other Business or Capital Expenses

Be it a free and clear restaurant or a property you recently acquired and need to pull out money for another transaction quickly, our cash-out refinance loan is designed to get you the money needed for your business purpose needs.

There is no limit on the number of properties.

Cash-Out Refinance Hard Money Loans

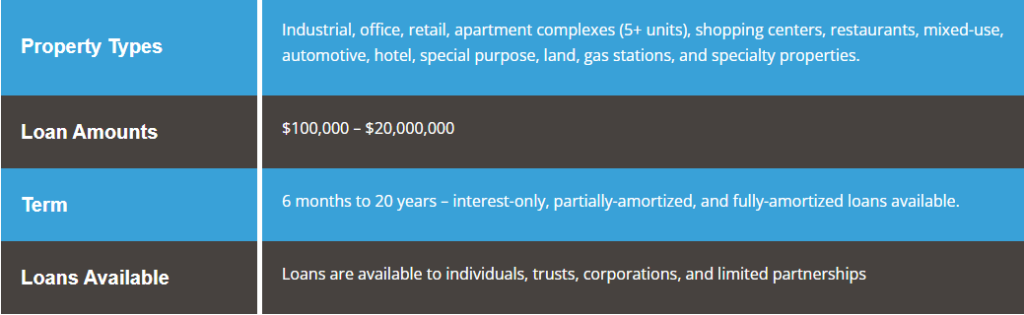

We offer both interest-only and term loans up to 20 years on our cash-out refinance loans, allowing you to choose a payment schedule that best fits your needs.

We originate cash-out refinance loans on all types of commercial properties. If for any reason you do not qualify for a traditional commercial mortgage loan, Socotra Capital is the lender of choice for the small business owner.

We are as good as cash. With no limits on the number of properties, you can leverage one building or your entire commercial portfolio.

Our customized cash-out refinance loan programs allow you to get a loan that best suits your business needs.