Note:

Purpose Of Construction Loans:

Construction Loans are used to finance the construction or renovation of commercial properties.

This can include new buildings or significant upgrades to existing structures.

Construct Loan Structures:

Unlike traditional loans, commercial construction loans are typically disbursed in stages, known as “draws,” as the construction progresses. This means funds are released based on project milestones.

Types of Construction Loans:

SBA CDC/504 Loans: These are backed by the Small Business Administration and are designed for major fixed assets like real estate.

SBA 7(a) Loans: Another SBA option, these are more flexible and can be used for a variety of business purposes, including construction.

Traditional Bank Loans: Offered by banks and credit unions, these loans often require strong financials and extensive documentation.

Mezzanine Loans: These are a hybrid of debt and equity financing, often used when additional funding is needed beyond what traditional loans can provide.

Interest Rates and Fees: Interest rates for commercial construction loans can vary widely based on the type of loan and the lender. There are also various fees involved, such as origination fees, processing fees, and sometimes even fees for each draw.

Down Payment: These loans usually require a significant down payment, often ranging from 10% to 30% of the total project cost.

Documentation: The application process can be lengthy and requires detailed documentation, including project plans, cost estimates, and financial statements.

Security: The construction site itself often serves as collateral for the loan.

Key Points

Construction loan are typically structured as short term hard money loans using hard money terms and rates.

Cash Flow Based Financing

Our lender partner provides liquidity to professional real estate investors with lowleverage, cash-flowing assets. They do this by leveraging the monthly cash flow of experienced rental investors’ entities to provide up-front capital, which you can then use to acquire new properties or improve existing properties.

Who is this program a fit for?

-

Real Estate investors with 3+ years experience managing or owning real estate

-

We work with any capital stack including funds, syndications or partnerships

-

Multifamily, long & short term rentals, self-storage, assisted living, student housing

-

Operators who are cash flow positive with less than 75% portfolio-level LTV

-

Operators with established business entities and business bank account

-

Multifamily, long & short term rentals, self-storage, assisted living, student housing

Use Cases

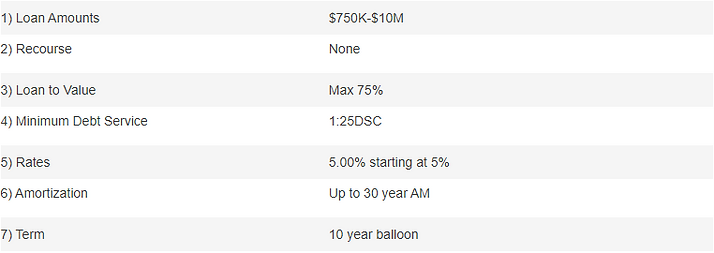

For Purchase, Refinance and Cash Out

Rate depends on market conditions at time of rate lock. Transactions costs run from $2,500 to $7,500 for Processing Fees, Plus Expense deposit for 3rd parties, legal and out of pocket expenses.

For Workout and Limited Rehabilitation

Rate depends on market conditions at time of rate lock. Transactions costs run from $2,500 to $7,500 for Processing Fees, Plus Expense deposit for 3rd parties, legal and out of pocket expenses.

Purchase, Refinance and Major Rehabilitation

For Purchase, Refinance and Cash Out

Rate depends on market conditions at time of rate lock. Transactions costs run from $2,500 to $7,500 for Processing Fees, Plus Expense deposit for 3rd parties, legal and out of pocket expenses.

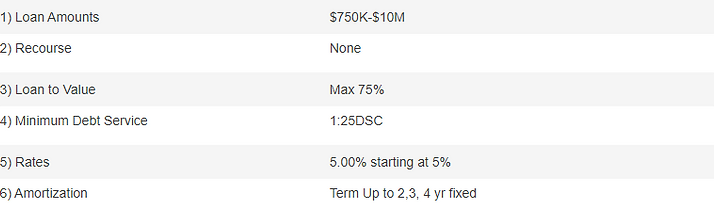

For Workout and Limited Rehabilitation

Rate depends on market conditions at time of rate lock. Transactions costs run from $2,500 to $7,500 for Processing Fees, Plus Expense deposit for 3rd parties, legal and out of pocket expenses.

Purchase, Refinance and Major Rehabilitation

Rate depends on market conditions at time of rate lock. Transactions costs run from $2,500 to $7,500 for Processing Fees, Plus Expense deposit for 3rd parties, legal and out of pocket expenses.